Power-Packing Your Lifestyle Professional Service Biz: Mastering Investment Strategies for Ultimate Freedom

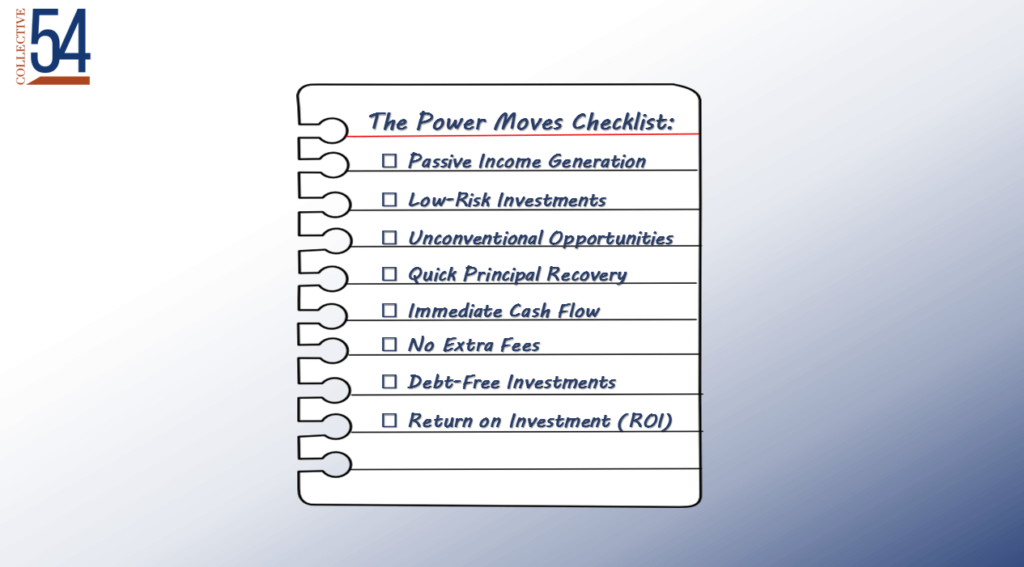

Today, I’m going to walk you through the power moves that will not just keep your cash flow strong, but also ensure your time is spent where it truly matters.