Power-Packing Your Lifestyle Professional Service Biz: Mastering Investment Strategies for Ultimate Freedom

Embarking on the entrepreneurial journey with a lifestyle professional service business? That’s a champ move, my friend. But to transform this venture into a gold mine, you need a game plan that’s both savvy and systematic. That’s where smart investment strategies come into play. Today, I’m going to walk you through the power moves that will not just keep your cash flow strong, but also ensure your time is spent where it truly matters. Let’s unlock the secret to financial autonomy, shall we?

Running a lifestyle service business is like mastering chess. You’ve got to stay focused on the king – financial independence. Your investment decisions should have one mission – an immediate positive cash flow that’s not just a drizzle but a downpour, allowing for a quick recovery of your principal investment.

Now, listen up. The golden rule in this playbook is to stay clear of debt and avoid selling equity. Instead, focus on making your operations lean, mean, and revenue-generating machines, creating an environment of financial stability and skyrocketing profitability.

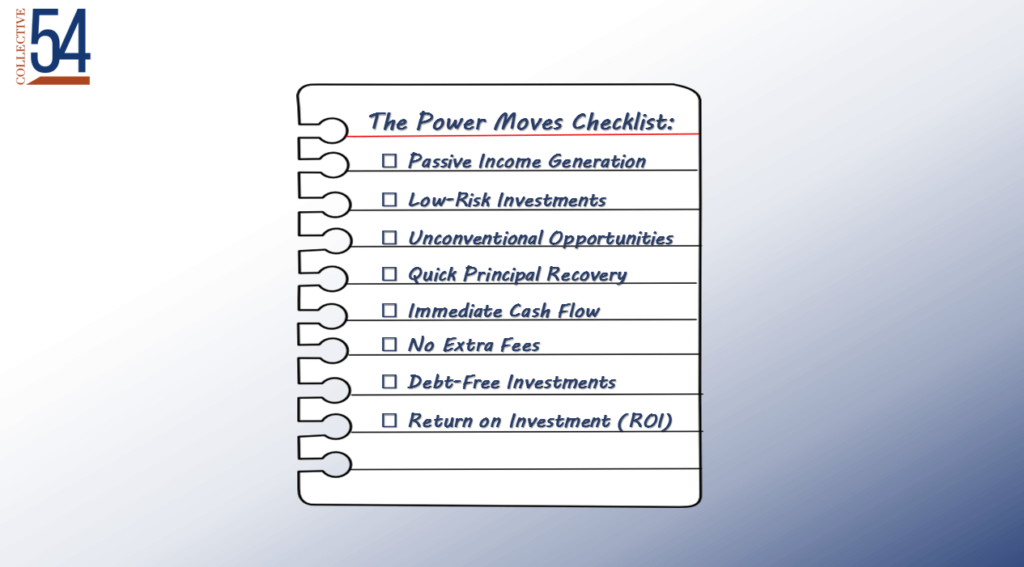

Investment Evaluation Tool for Lifestyle Businesses: Your Power Moves Checklist

Evaluating investments can be a battlefield. But we’ve got an ace up our sleeve – The Investment Evaluation Tool. This little cheat sheet focuses on eight key power moves:

- Passive Income Generation: We’re talking about money that rolls in with minimal effort.

- Low-Risk Investments: Pick opportunities that keep financial risk at bay.

- Unconventional Opportunities: Go for the unique, the uncommon – just the kind you’d find in lifestyle professional service firms.

- Quick Principal Recovery: The golden window – get your initial investment back within the first year.

- Immediate Cash Flow: The investment should start making it rain from the get-go.

- No Extra Fees: Stay clear of those pesky extra fees for service providers.

- Debt-Free Investments: Keep it clean – no debt.

- Return on Investment (ROI): Each dollar you put in should come back with friends.

- Passive Income Generation: We’re talking about money that rolls in with minimal effort.

Want and example of a Collective 54 member who used this checklist well? Listen here to Mike Braun of Pivotal Advisors. Mike is growing his firm beyond a lifestyle business by making smart investment decisions.

Timing Your Investments: The 4-Step Power Play

Wondering whether to invest more in your firm, or when to go all-in? Here’s your four-step power play:

- Basic Living Expenses: Figure out what it takes to cover the essentials.

- Current Lifestyle Expenses: Determine your lifestyle’s upkeep cost.

- Ideal Lifestyle Expenses: Dream big – what’s the price tag on that?

- Passive Income Goal: Set the bar – how much do you need from investments to live off passive income?

- Basic Living Expenses: Figure out what it takes to cover the essentials.

These steps empower you, the lifestyle business owner, to gage how much to invest. Only invest when your firm is past points 1 and 2. They measure risk. Then, do the math on points 3 and 4. Only invest when the size of the prize (ideal life and/or freedom) is worth the risk. Risk and return are correlated.

But remember, there’s a villain in every story – here it’s lifestyle inflation. As your income goes up, so can your spending. But we’re smarter than that, right? To keep your financial freedom intact, choose investments that produce income, growing faster than your lifestyle costs. You don’t need the yacht, the plane, nor the second home. Buy them, but only after you can easily afford them.

Finally, aim for asymmetric returns: opportunities that offer a high upside with limited downside. This will enhance your overall profitability and turbocharge your lifestyle business performance.

So, there you have it. As a lifestyle business owner in the professional service industry, your ticket to financial independence is a series of well-played, strategic investment decisions. Get that cash flow engine revving, minimize lifestyle inflation, and you’re looking at an entrepreneurial journey that’s not just rewarding but truly liberating. Now go forth and conquer!

If you want to meet your peers who do this well, consider joining our community, Collective 54.