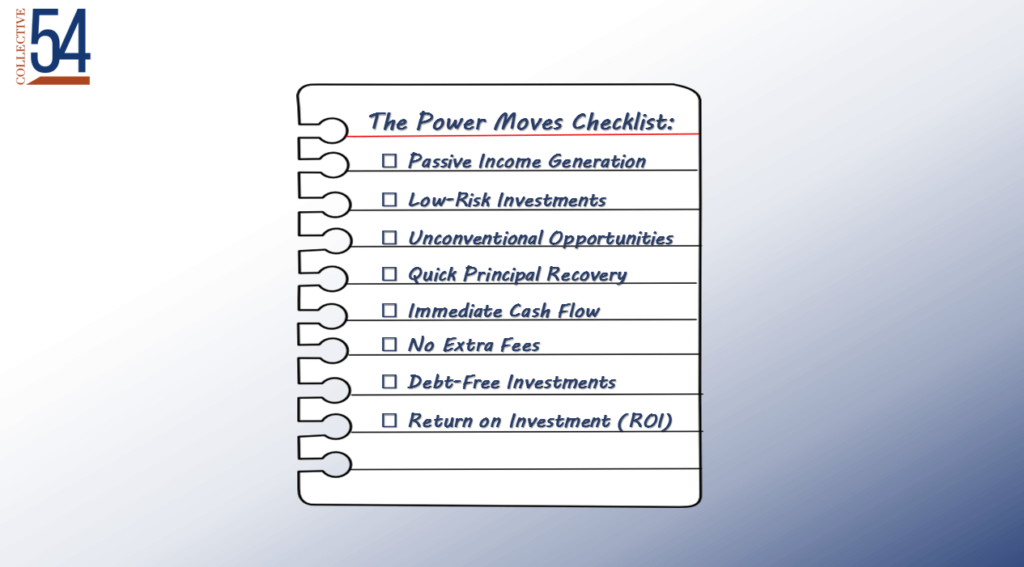

The True Cost of Self-Publishing: Why It’s Costing You More Than You Think

In the competitive landscape of boutique professional services, it’s crucial to elevate your status beyond that of a consultant to become recognized as the foremost authority in your niche. By positioning yourself as an authority, you can unlock new opportunities and take your boutique service firm to greater heights.