Organic Growth vs. Acquisition Growth: How Pro Serv Firms Win Through Acquisitions

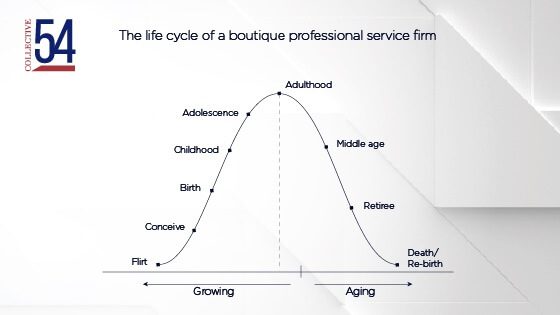

If you’re considering exiting your firm one day, you’re thinking about how much your firm is worth. Whether you’re passing it on to the next generation or selling it, you want your firm to be worth as much as possible. And to do that, your firm needs to grow. One method of growth is to grow by acquisition.

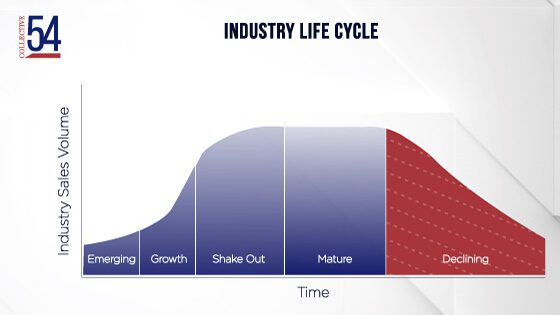

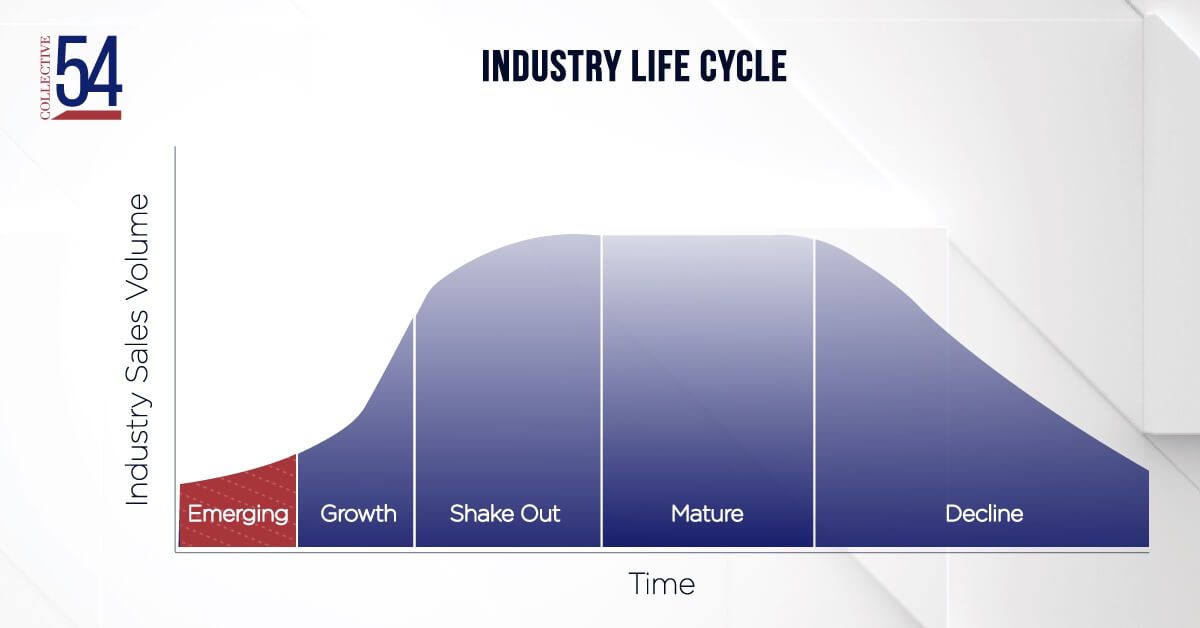

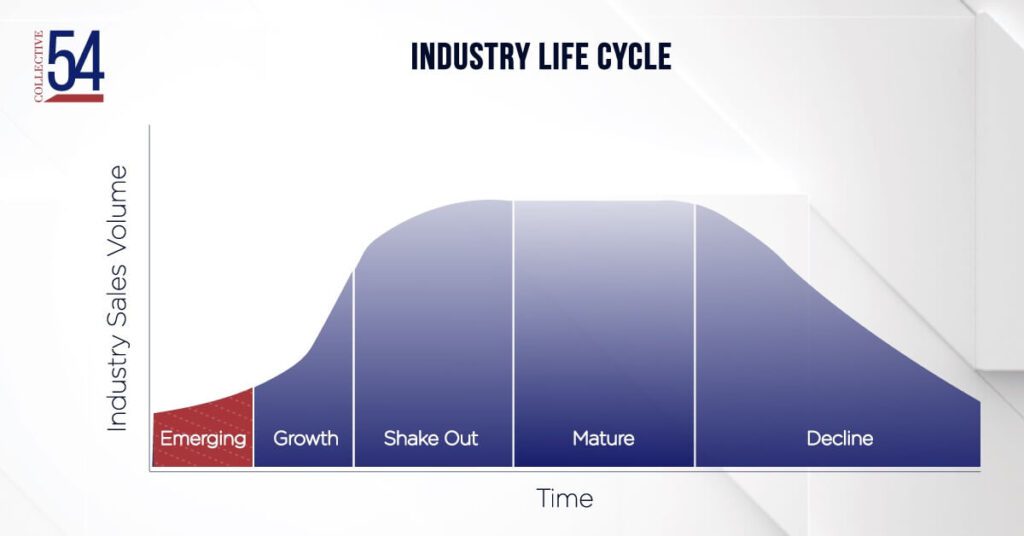

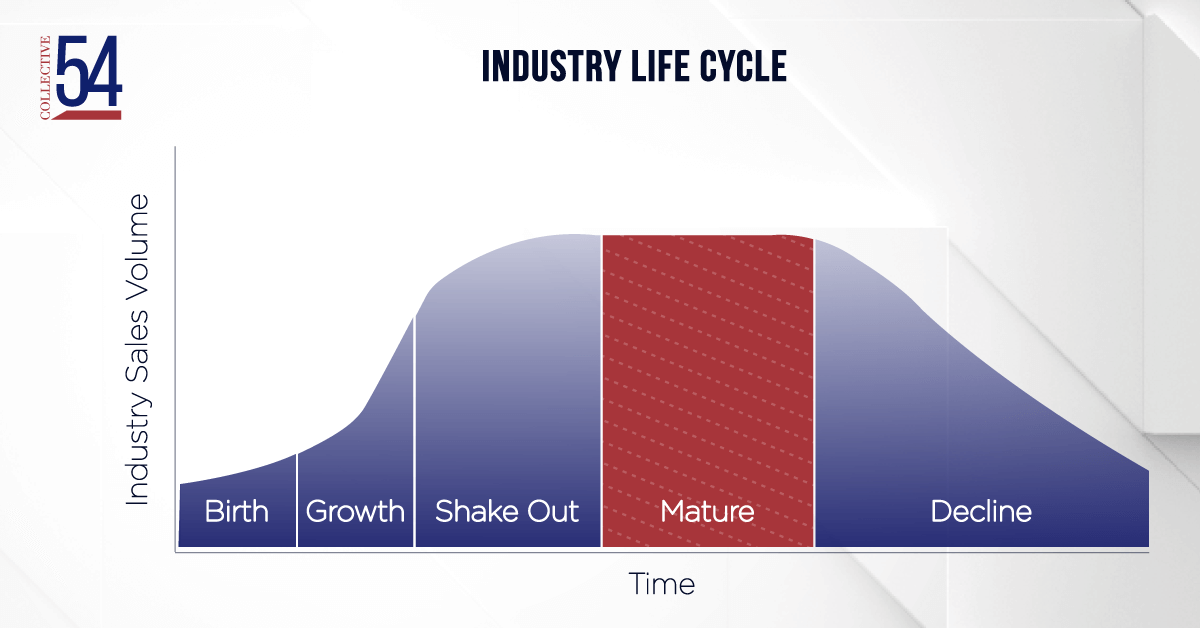

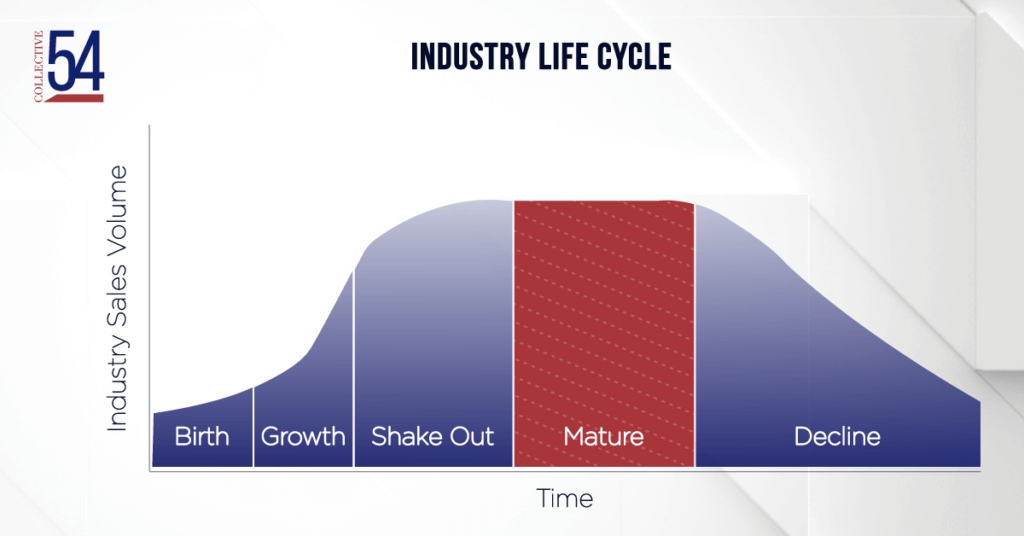

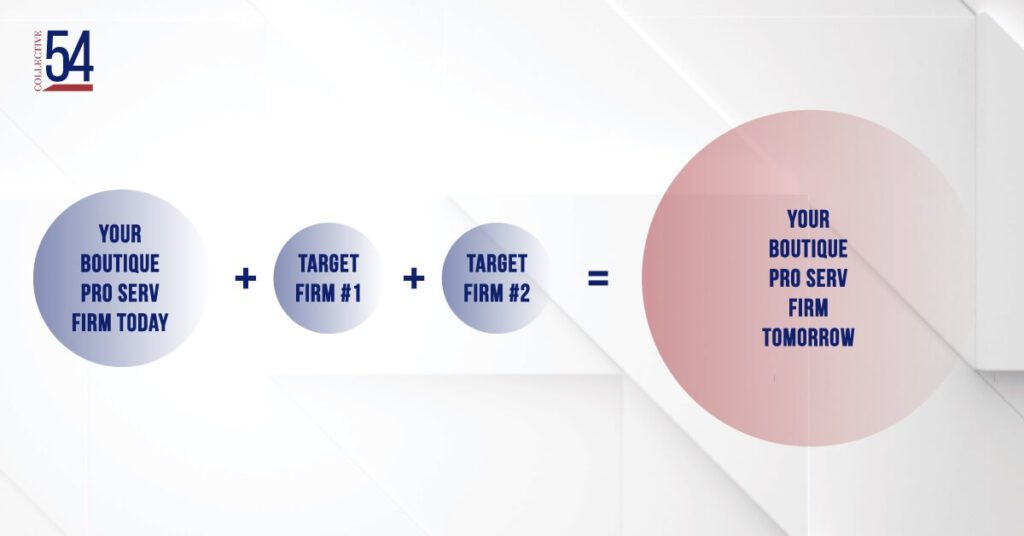

The reason a boutique professional service firm should consider an acquisition is to grow by entering a new market. Revenue growth drives firm valuation, and if growth in the core business has slowed, the firm is worth less. Thus, the wealth you’ve worked hard to create is reduced. Before that happens, your firm needs to find new growth opportunities. Often, these growth opportunities are in new markets, such as different geographical locations, industries, or service categories. Acquiring a firm operating in a new market is a potential way for you to enter.

Organic vs. acquisition growth

Traditionally, there are three ways to enter a new market. You can build the practice internally, partner with a firm in the desired market, or buy a firm operating in the target market. All three methods can be successful.

So, the question is: Should you build, partner, or buy? This question gets answered when you ask how much time do I have, how much is it going to cost, and how much risk am I willing to tolerate? When it is faster, cheaper, and less risky to acquire, you should make an acquisition. If it is faster, cheaper, and less risky to enter a new market by building internally or partnering, you should pursue organic growth.

Determining if it’s the right time and place for you to acquire another firm

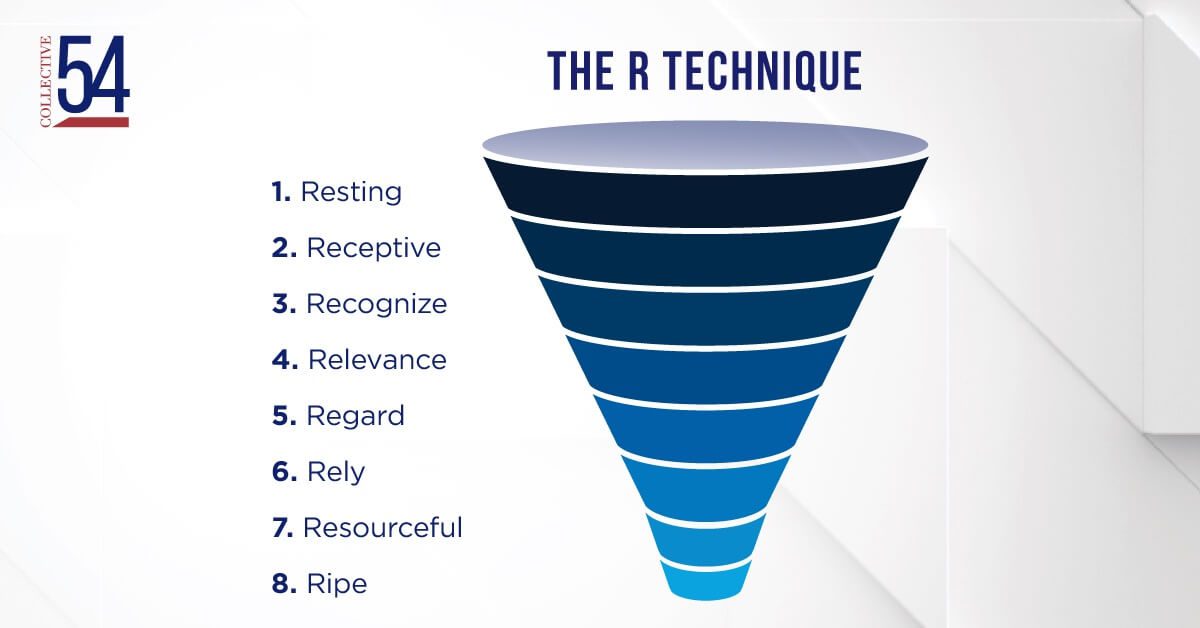

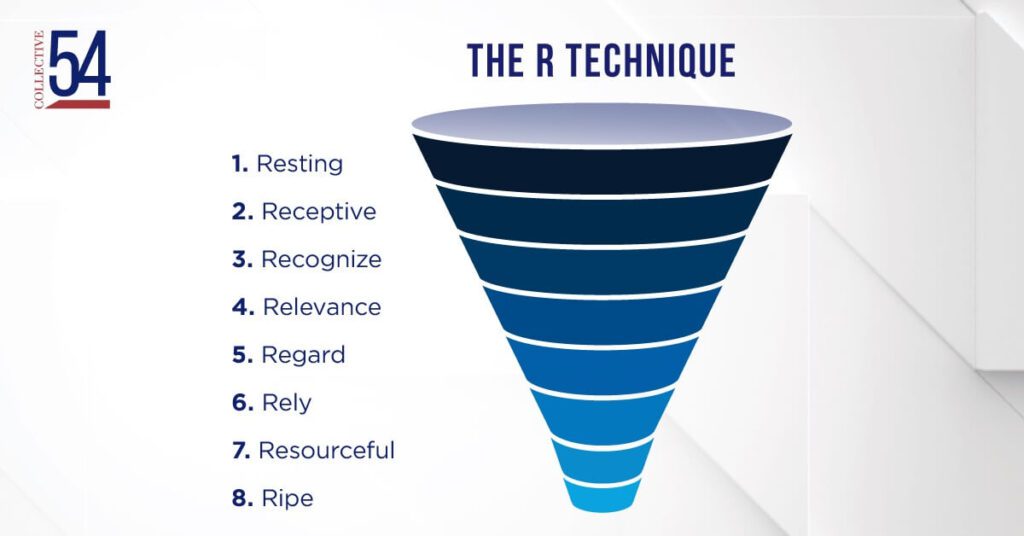

There are five key questions a founder of a professional service firm needs to ask themselves to determine if the conditions are ripe for an acquisition. Those questions are:

1. Do you have superior information?

For example, you know how to get access to clients and the target firm does not.

2. Are you the only bidder?

Many, if not most, professional service firms are lifestyle businesses that cannot attract a buyer. When you are the only bidder, you dictate price and terms.

3. Are we in a recession?

Recessions are fantastic for well-run boutiques, but they punish poorly run boutiques. During recessions, some firms get in trouble and may need a lifeline to stay in business, making them a good candidate to be bought.

4. Is the selling firm sick?

In this instance, the underperforming firm is attractive, and the performing firm is unattractive. You can buy the sick firm, enter the new market, cure the illness, and thrive.

5. Does the seller care about things beyond price?

Boutique professional service firms, run by founders like you, are more than financial vehicles. These founders care just as deeply about their clients, employees, and legacy as you do. A founder wants to know their people, clients, and reputation will be well taken care of post-acquisition. When dealing with an idealistic founder, conditions are ideal for an acquisition. When dealing with a mercenary founder focused only on money, the conditions are not ideal and the price will likely be too steep.

Setting up your acquisition for success

After you’ve determined it’s the right time to buy, there are two key steps to take to make sure your growth-through-acquisition strategy works.

First, you must buy at the right price. Unfortunately, most boutique pro serv firms overpay when making acquisitions. They are inexperienced in determining the right price and in doing deals. Most founders have never bought a firm before and make mistakes. They focus entirely on the math, such as a multiple of earnings before interest, taxes, depreciation, and amortization (EBITDA) or revenue. This is important, but doing a deal is much more than that.

When determining the correct price for acquisition success, only enter negotiations with a founder who has a great compulsion to sell. Walk away from sellers on the fence. Founders of boutique professional service firms who are compelled to sell usually have one or more of these complications in their life.

They have estate problems. For example, maybe they are getting divorced, and the firm is an asset owned by both spouses.

They need capital in a hurry. Maybe they have a debt on the balance sheet that needs to be paid off.

They’ve recently lost their successor and see no way out. For example, an absentee owner has been getting rich off a young executive’s back and the young executive quits.

They need capital to grow and cannot get access to it. Perhaps a firm wins a big new contract and needs to hire up before the first invoice is collected.

They realize they have a below-average management team and need new blood. For example, the founder tried to delegate, it flopped, and they’re back to grinding out 60-hour weeks.

The second key step to take is to be sure you have a unique ability to operate the acquired firm. Practically speaking, this means you have a much better team than the acquired firm. And when I say much better, I mean at least twice as good. This protects your downside. If the team of the acquired firm quits, your team is capable of picking up where the previous team left off. And it helps you capture the upside. Your team will execute better and deliver more growth and better profits.

An experienced community to support you

If this is the first acquisition you’re pursuing or your previous acquisition didn’t go smoothly, join the Collective 54 community. Our members are founders and operators of professional service firms like you that have been in your shoes. They are happy to advise you on the best next steps for your firm.

To determine where your firm is right now, your first step should be to find out the valuation of your firm. Check out our free Firm Estimator tool here.