Understanding the Transition: From Non-Recurring to Recurring Revenue Models in Boutique Professional Service Firms

Understanding the Challenge

For founders of boutique professional service firms, the shift from a non-recurring revenue model to a recurring revenue model is often a strategic move towards long-term stability and growth. However, this transition can be challenging, especially in terms of cash flow management. This article aims to guide you through this complex yet rewarding journey.

The J Curve: A Critical Concept

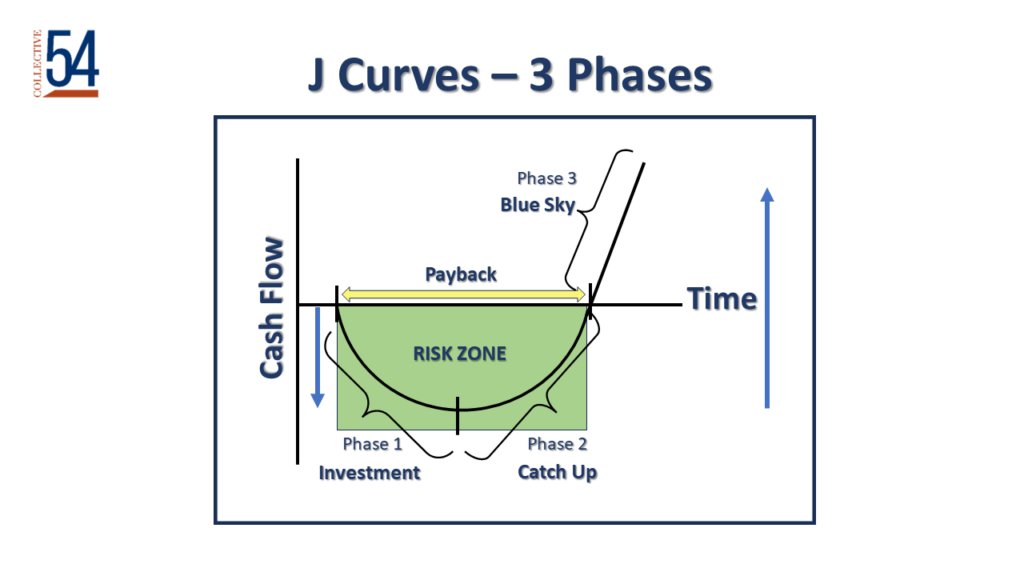

Before delving into the specifics, it’s essential to understand the concept of the J Curve in the context of this transition. The J Curve is a visual representation of a company’s cash flow following a significant investment or change in business strategy – initially, there’s a significant outflow of cash (the bottom of the ‘J’), but with time and effective management, the curve ascends, leading to increased profitability.

How the J Curve Applies

When switching to a recurring revenue model, your firm initially faces increased costs without immediate returns. These costs include client acquisition, setting up systems for recurring billing, and potentially, a temporary dip in revenues as you transition existing clients or onboard new ones. This initial phase represents the bottom of the J Curve.

Calculating Break-Even for a Given Client

To navigate this period, a clear understanding of the break-even point for each client is crucial. Here’s how to calculate it:

- Cost to Acquire (CTA): This includes marketing expenses, sales team costs, and any other costs directly related to acquiring a new client.

- Cost to Serve (CTS): These are the ongoing costs of servicing a client, including labor, software, or other resources.

- Overhead Allocation: Allocate a portion of your firm’s overhead costs to each client, based on a reasonable metric like revenue contribution or service hours.

Break-Even Point Calculation

Your break-even point is when your cumulative revenues from a client equal the sum of CTA, CTS, and allocated overhead.

The Exponential Profit Beyond Break-Even

Once the break-even point is met, each additional dollar from the client significantly contributes to your firm’s profitability. This exponential increase is due to the recurring nature of the revenue and the decreasing marginal cost of serving a client over time.

The number one reason boutique professional service firms do not make the transition to recurring revenues is they cannot handle the cash crunch. Firms get used to big checks hitting the bank account in a traditional project-based billing cycle. It is difficult to tell a client not to pay them so much this quick but rather pay them over time pro rata over the life of the contract. The founder sees the payroll going out without the revenue coming in and the cash balance in the bank account dwindle month over month, panics, and says “recurring revenue is not for us.” This is a mistake and there are solutions to the cash flow issues.

Overcoming Cash Flow Obstacles

Short-Term Solutions

- Leverage Credit Facilities: A short-term loan or line of credit can help manage cash flow during the initial phase.

- Re-negotiate Payment Terms: With suppliers or landlords, for instance, to align outflows with your new revenue model.

Long-Term Strategies

- Optimize Client Acquisition Costs: Use data-driven marketing and sales strategies to reduce CTA.

- Efficiency in Service Delivery: Streamline processes to lower CTS.

- Client Retention: Implement strategies to retain clients, as the longer a client stays, the more profitable they become.

Conclusion

Transitioning to a recurring revenue model in a boutique professional service firm is a strategic move towards sustainable growth. Understanding and managing the J Curve, accurately calculating the break-even point, and implementing strategies to mitigate cash flow challenges are key to successfully navigating this transition. With careful planning and execution, the move to a recurring revenue model can lead to increased stability and profitability for your firm.

Are you wondering how to transition to recurring revenue? Or how to address the cash flow issues associated with the move? These strategic questions, as well as many others, get answered by your peers in the Collective 54 mastermind community. Consider joining by applying here