Episode 58 – Growth Rate: The Ultimate BS Detector – Member Case with Darren Isaacs and Paul Emery

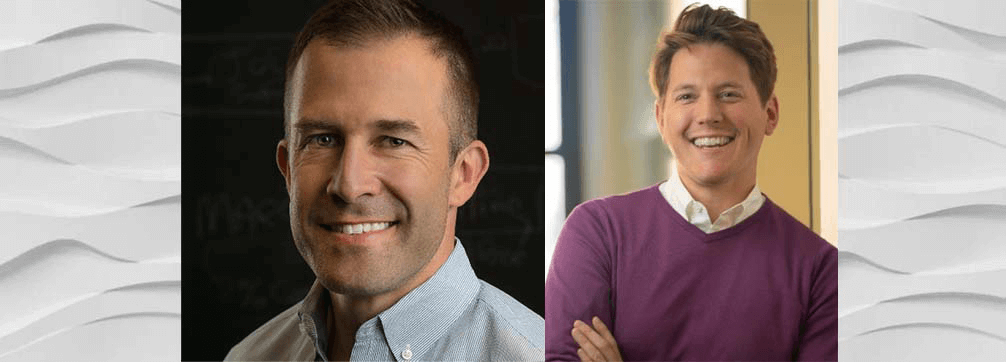

Your growth rate is important than the size of your firm. It is more important than your client roster, and it is more important than your service offerings. On this episode, we interview Darren Isaacs, Co-Founder and CEO, and Paul Emery, Co-Founder at Makosi.